Hi, I have earned a decent amount of capital after a few years of making money online from blogging and affiliate, then I started playing crypto and forex since 2019. Thanks to learning from forex experts such as: George Soro, Bill Lipschutz, Stanley Druckenmiller, Bruce Kovner… I have avoided losing a lot of “unjust” money. Below are my 12 secrets to becoming a successful forex trader after 4 years of forex trading.

1. Educate Yourself Extensively

Forex is a business that requires a lot of knowledge, experience and a lot of failures. I spent the first year of 2019 just learning and experimenting with trading. Of course, if you learn the right tips, you can be successful in the first 2-3 months.

Key Points

– Learn forex terminology, currency pairs, technical/fundamental analysis

– Read books, take courses, study demo trading, gain experience

– Continuous learning essential for success in dynamic forex market

No1 resource is the book. You can search top 10 books on Amazon as below:

– Currency Trading for Dummies

– Forex Trading: The Basics Explained in Simple Terms

– A Beginner’s Guide to Day Trading Online

– The Little Book of Currency Trading

– Technical Analysis of the Financial Markets

– The Art and Science of Technical Analysis

– The Candlestick Course

– The Visual Investor

– ICT Trading: The Secret Power Of Three (PO3)

– The Art of Currency Trading

Mastering forex trading basics and having in-depth knowledge builds a solid foundation for a successful trading career. Stay committed to being a lifelong student.

2. Manage Risks Prudently

Risk management helps limit trading losses and ensures survival in the forex market’s high-risk environment. Set aside a small portion of your capital per trade, never risking more than 1-2% on a single trade. Use stop-loss orders on every trade to control potential losses. Reduce position sizes if losses mount. Diversify with low-correlated trading strategies. Avoid overleveraging yourself. Prioritize risk management over profit goals.

Key Points

– Limit trade risk to 1-2% of capital

– Use stop-losses to control loss on trades

– Diversify strategies and asset classes

– Reduce leverage and position sizes if facing losses

– Effective risk management ensures longevity

Losses are inevitable, but effective risk management will ensure you have capital left to regain profitability. It enables you to weather storms and come out profitable over the long-term.

3. Develop a Trading Plan

One of the most important tips is to have a well-defined trading plan that includes your goals, risk tolerance, strategies, and steps for analyzing the market. Trading without a plan leads to emotional decision making and reckless trades. Define parameters for your trades, including when to enter, exit, and manage risk. Stick to your plan consistently despite losses or fluctuating emotions. Review and tweak your plan periodically as you gain experience.

Key Points

– Trading plan provides structure, strategy, risk guidelines

– Reduces emotion-based trading decisions

– Include goals, risk limits, trade entry/exit rules

– Stick to plan consistently despite losses

– Review and adjust plan as you gain experience

Having a trading plan is one of the integral pillars of successful forex trading. It provides clarity amidst the chaos of the trading environment.

4. Start With a Demo Account

Open a demo account and simulate live trading without risking real capital. Use the demo account to practice and get familiarized with your trading platform’s features. Test your trading strategies and find any flaws that need refinement. Demo trading builds experience without financial consequences and develops confidence. Ensure you can profit consistently on your demo account before funding a live account.

Key Points

– Practice trading strategies on demo account

– Gain experience without financial risk

– Build confidence by testing strategies

– Refine strategies and find flaws

– Switch to live account after achieving consistency

Demo trading is an invaluable tool for developing your skills. Treat your demo account seriously, and only go live once you achieve regular profits.

5. Choose a Reputable Broker

Choosing a reliable and reputable forex broker fundamentally impacts your trading experience. Ensure the broker is registered with regulatory bodies like the NFA, FCA, or CySEC and compliant with all regulations. Check reviews and complaints online about the broker. Consider factors like spreads, fees, platform features, account options, and customer service. Avoid shady brokers offering unbelievable incentives. Choose an established broker with a long-term track record.

Key Points

– Ensure broker is regulated properly

– Check reviews and complaints online

– Compare spreads, fees, features of top brokers

– Avoid untrustworthy brokers with gimmicks

– Choose an established, reputable broker

Your broker acts as your gateway to the forex world. A reliable broker provides peace of mind and facilitates your trading success.

6. Develop Patience and Discipline

Patience and discipline are essential for forex trading success. Searching for the “perfect” entry leads to missed opportunities. Don’t chase trades if your plan’s conditions aren’t met. Stay calm after losses, sticking to your plan and waiting for the next opportunity. Avoid overtrading by managing frequency of trades. Establish a routine and develop self-control. Set realistic goals and take profits at pre-planned levels. Patience and discipline separate the successful from the rest.

Key Points

– Don’t chase trades outside your plan

– Stay calm and stick to plan after losses

– Control overtrading tendencies

– Establish routine and self-control

– Take profits at pre-planned levels

– Patience and discipline lead to success

Cultivating patience and discipline ensures you stick to your trading plan. This minimizes emotional errors and builds consistency over the long-term.

7. Develop Robust Trading Psychology

Cultivating a strong trading psychology is vital for long-term success. Don’t let emotions like greed and fear dictate your trades. Have confidence in your plan and abilities. Embrace a “less is more” mindset, focusing on quality over quantity. Trade patiently without feeling pressured. View mistakes as learning experiences, not failures. Stay positive, motivated and consistent in your approach. Your mental framework impacts all aspects of trading.

Key Points

– Trade rationally without emotional bias

– Have confidence in your abilities

– Adopt a patient, high-quality mindset \n- Learn from mistakes

– Stay motivated, positive and consistent

– Trading psychology affects overall performance

Developing robust trading psychology establishes consistency, discipline, and patience in your approach. Master your mindset and you’ll master forex trading.

8. Keep Up With Fundamentals

Fundamental analysis studies how economic events and financial developments affect currency valuations. Keeping up-to-date with news, data releases, central bank policies, geopolitics, and global markets is crucial. Understand how news impacts your currency pairs. Modify your trading plan based on fundamental changes. Sign up for news calendars to monitor impactful events. Fundamentals drive long-term currency trends.

Key Points

– Study impact of news events on forex

– Follow central bank policies, data releases

– Keep up-to-date with financial news

– Adjust trading plan based on fundamentals

– Fundamentals drive long-term forex trends

Combining technical studies with fundamental analysis provides valuable context for high-probability trades. Ignore fundamentals at your own peril.

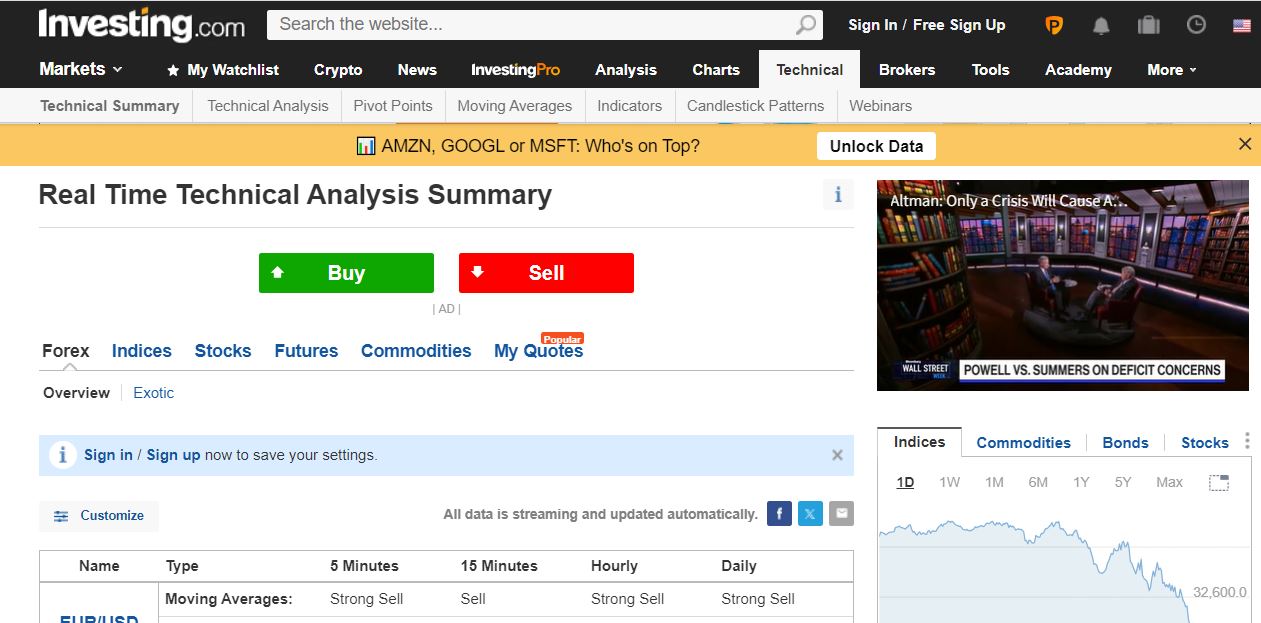

9. Utilize Technical Analysis

Technical analysis helps forecast price movements by studying historical charts and market-generated data points. Using technical indicators like moving averages, Bollinger bands, and oscillators can help identify trading opportunities. Perform technical analysis on various time frames to understand the broader market structure. Combine technical studies of price trends with fundamental drivers. Always use technical analysis with a risk management strategy.

Key Points

– Analyze price charts with indicators

– Identify trading opportunities

– Study short- and long-term timeframes

– Combine with fundamental analysis

– Use technical analysis with risk principles

Technical analysis provides insights into market psychology and identifies high-probability trading opportunities to boost profitability.

10. Specialize in One or Two Currency Pairs

There are dozens of currency pairs, but trying to trade them all leads to confusion and information overload. Specialize in just one or two currency pairs like the EUR/USD or USD/JPY. Thoroughly learn their trading characteristics. Focus on your specialty pairs instead of jumping around. In-depth experience with a limited number of pairs increases accuracy. Become an expert on your currency pairs.

Key Points

– Trading dozens of pairs causes overload

– Specialize in one or two pairs

– Thoroughly learn the pairs’ behavior

– Build extensive experience trading them

– Become an expert on your specialty pairs

Becoming an expert on just a few pairs allows greater focus, confidence, and accuracy in your trading decisions.

11. Keep Detailed Trading Records

Keep a detailed record of every trade, including the rationale, price action analysis, entry/exit points, risk management, profit or loss margin, and reflections. Review your trading journal periodically to learn from past successes and mistakes. Understanding your wins and losses enables refinement of your edge. Track key metrics like risk/reward ratios, win percentages, and more. Measure progress systematically.

Key Points

– Record details of every trade

– Review journal to identify strengths, weaknesses

– Learn from past wins and losses

– Track key performance metrics

– Journal provides clarity amid losing streaks

Maintaining a detailed trading journal leads to process refinement, skill development, and consistency. It provides an invaluable self-assessment tool.

12. Join a Trading Community

Isolation can be detrimental in trading. Network and join an online trading community to discuss ideas with like-minded traders. Staying in touch with peers provides motivation, accountability, differing perspectives, and inspiration through exchange of knowledge. Interacting with experienced professionals accelerates your learning curve. Find a community that resonates with your approach.

Key Points

– Avoid isolation, network with fellow traders

– Communities provide motivation & accountability

– Accelerated learning through shared knowledge

– Get feedback and differing viewpoints

– Find a community aligned to your style

The support and shared wisdom of a trading community can bolster your growth as a trader in indispensable ways.

Conclusion

Mastering forex trading requires extensive skills and wisdom acquired over time. Employ these essential tips to stack odds in your favor. Continuously learn about forex, create a strategic plan, manage risk smartly, develop a winning psychology, analyze the market probabilistically, and take full responsibility. With hard work, dedication, patience and discipline, you can become a successful forex trader. Remember – persist, adapt and succeed.