Last month I published the article: “10 steps to make $12,000+ per month from crypto trading“, after receiving requests from readers, today I continue to compile the article tips to trade crypto successfully. Hope you will like it.

1. Determine your trading strategy

Will you be day trading, swing trading or position trading? Each strategy has pros and cons. Day trading involves making multiple trades per day to capitalize on short-term price movements. Swing traders hold assets for days or weeks. Position traders have a long-term outlook spanning months or years. Choose a strategy that aligns with your risk tolerance and goals.

Looking to elevate your crypto trading game? Here are some top strategies to consider:

– Trend following: Ride the waves and capitalize on upward or downward trends.

– Breakout trading: Identify key levels of support and resistance and enter trades when prices break out.

– Range trading: Take advantage of price fluctuations within a defined range.

– Scalping: Execute quick trades to capture small profits from frequent market movements.

– Fundamental analysis: Study market news, events, and project developments to make informed trading decisions.

– Swing trading: Capitalize on short-term price swings over a few days or weeks.

– Arbitrage: Exploit price differences between different exchanges or markets for profit.

These strategies can help you navigate the dynamic world of cryptocurrency trading with confidence.

2. Use stop-loss and take-profit orders

Stop-loss and take-profit orders are essential risk management tools for crypto trading. Stop-loss orders automatically sell at a predefined price level to contain losses. Take-profit orders lock in gains by selling at a set target price.

Using stop-losses protects capital from sudden crashes. Take-profits capture upside price movements. Stop-losses and take-profits work together to exit positions at optimal levels despite market volatility. They enable traders to stick to trading plans without having to monitor the market 24/7.

3. Making Use of Technical Analysis Tools for Better Decision-Making

When it comes to navigating the dynamic and complex landscape of financial markets, having access to reliable information is essenttial for achieving success. For traders and investors, understtanding the nuances of market trends and price movements can be a deciding factor in making informed decisions. This is where technical anallysis tools come into play – they offer valuable insights that can significantly improve the decision-making process.

One popular tool used by traders and investors is candllestick charts. By analyzing patterns and formations on these charts, traders can identify potential trend reversals or continuation patterns, helping them make more accurate predictions about future price movements.

Moving averages indicators are another powerful tool used in technical analysis. They smooth out price data over a specified period of time, providing a clearer picture of the overall trend. Traders often use moving averages to identify support and resistance levels or to generate buy and sell signals.

RSI (Relative Strength Index) is a popular momentum oscillator that measures the speed and change of price movements. It helps traders identify overbought or oversold conditions in an asset, indicating potential reversals in the market.

MACD (Moving Average Convergence Divergence) is another widely used indicator that combines moving averages to provide insights into both trend strength and momentum. Traders often look for bullish or bearish crossovers on the MACD line as potential entry or exit points.

4. Welcome to crypto FOMO:

Don’t let FOMO (Fear Of Missing Out) drive your crypto trading decisions. Here are some essential tips to help you stay grounded and make informed choices:

– Research thoroughly before investing.

– Set realistic goals and stick to your strategy.

– Diversify your portfolio to manage risks.

– Avoid impulsive buying based on market trends.

– Practice disciplined trading by setting stop-loss orders.

– Stay updated with reliable news sources for accurate information.

– Don’t invest more than you can afforrd to lose.

– Seek advice from experienced traders or financial advisors.

Remember, successful crypto trading requires patience, knowledge, and a rational mindset.

5. Use Risk Management Techniques:

Implement risk management techniques to protect your capital. Set stop-loss orders to limit potential losses and consider diversifying your portfolio to minimize risk exposure.

Crypto trading, while offering exciting opportunities for financial gains, comes with its fair share of risks. It is crucial to be aware of these potential pitfalls to safeguard your investments:

– Volatile market fluctuations make prices unpredictable.

– Lack of regulations exposes traders to potential scams and frauds.

– Security breaches and hacking attacks pose a threat to digital wallets.

– Lack of knowledge and experience can lead to poor decision-making.

– Liquidity issues may hinder the ability to buy or sell cryptocurrencies promptly.

– Market manipulation by whales can impact prices negatively.

– Stay vigilant and informed to mitigate these risks effectively.

6. Start small with 30-40% Funds

It is highly recommended to commence your investment journey by allocating a smaller portion of your total funds into the market and progressively upscaling as you gain more knowledge about the market and acquire confidence. It is suggested to start with approximately 30-40% of your entire investment portfolio to minimize any potential risks associated with investing.

By starting with a smaller portion of funds, one can avoid probable losses while also experimenting with different investment options and analyzing their performance. This approach allows investors to learn from their mistakes and adjust their investment strategy accordingly without signifiicant financial damage.

7. Go with market cap than affordability

As a beginner in cryptocurency trading, you may be tempted to jump into the market and buy a coin simply becausse its price is low. However, this apprroach may not always lead to the most profittable investment decisions. Instead of solely focusing on affordabillity, it’s importtant to also take into account the market cap of the coin before making any investment decisions.

Market capitalilzation refers to the total value of all the coins in circulation for a particular cryptocurency. This figure can give you a better understanding of the overal demand for the coin and its potential for growth or decline. In general, coins with higher market caps are considered safer investments as they have establlished themselves in the market and have a larger following.

Therefore, as a rule of thumb, it’s generally better to use market cap as a key factor in deterrmining whether or not to invest in a particular cryptocurrency. By doing so, you can make smarter investtment decisions that are based on real data and analysis rather than simply relying on price alone.

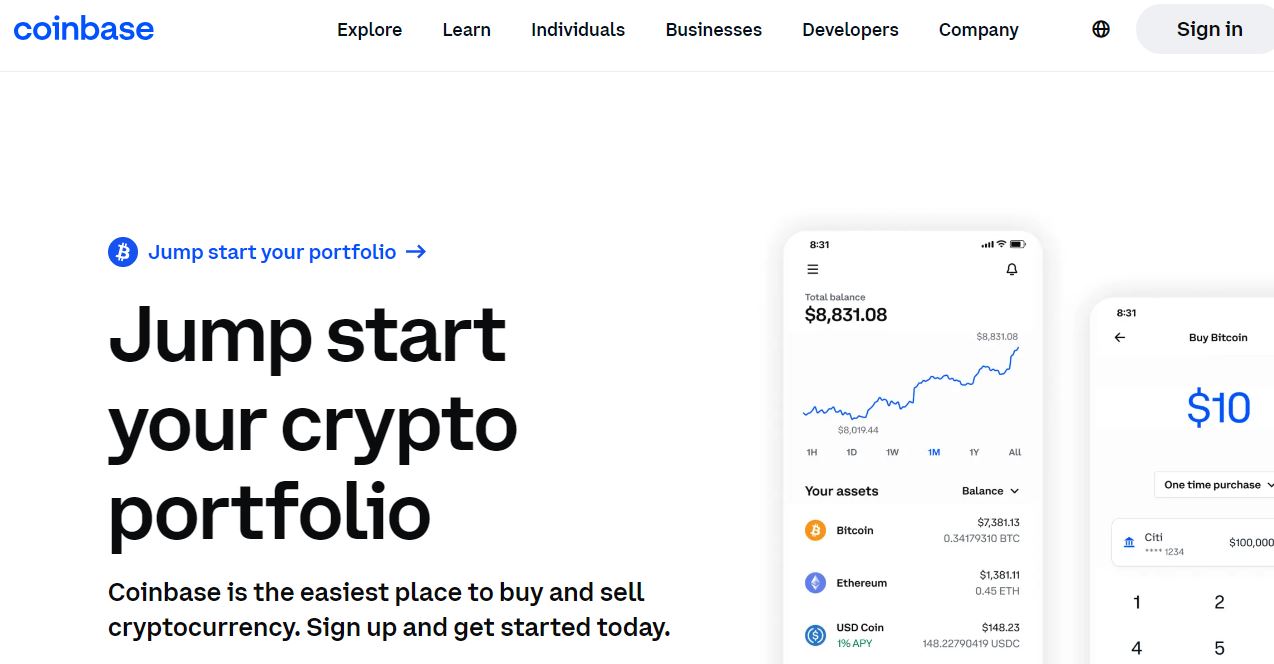

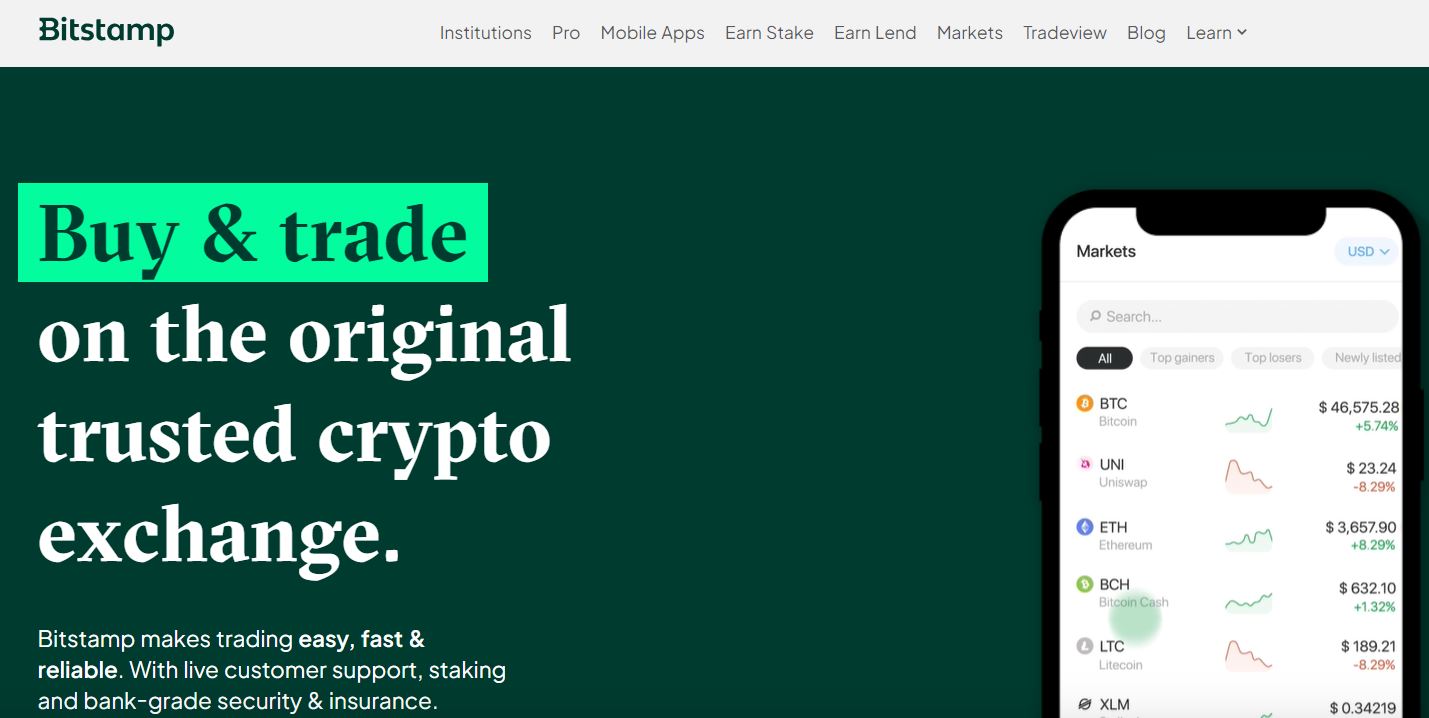

8. Use Reliable Exchanges:

Choose reputable and secure cryptocurrency exchanges for trading. Ensure they have robust security measures, good liquidity, and a user-friendly interface. Research the exchange’s reputation and read user reviews before trusting them with your funds.

Conclusion:

Trading cryptocurrencies profitably takes dedication, perseverance and a commitment to continuous education. Patience and discipline are required to manage risk, identify opportunities, implement strategies and refine skills. With the right mindset and approach, crypto trading can be an exciting pathway to profitability. Stay rational, humble and focused during the journey.